Customs: Moving to digital

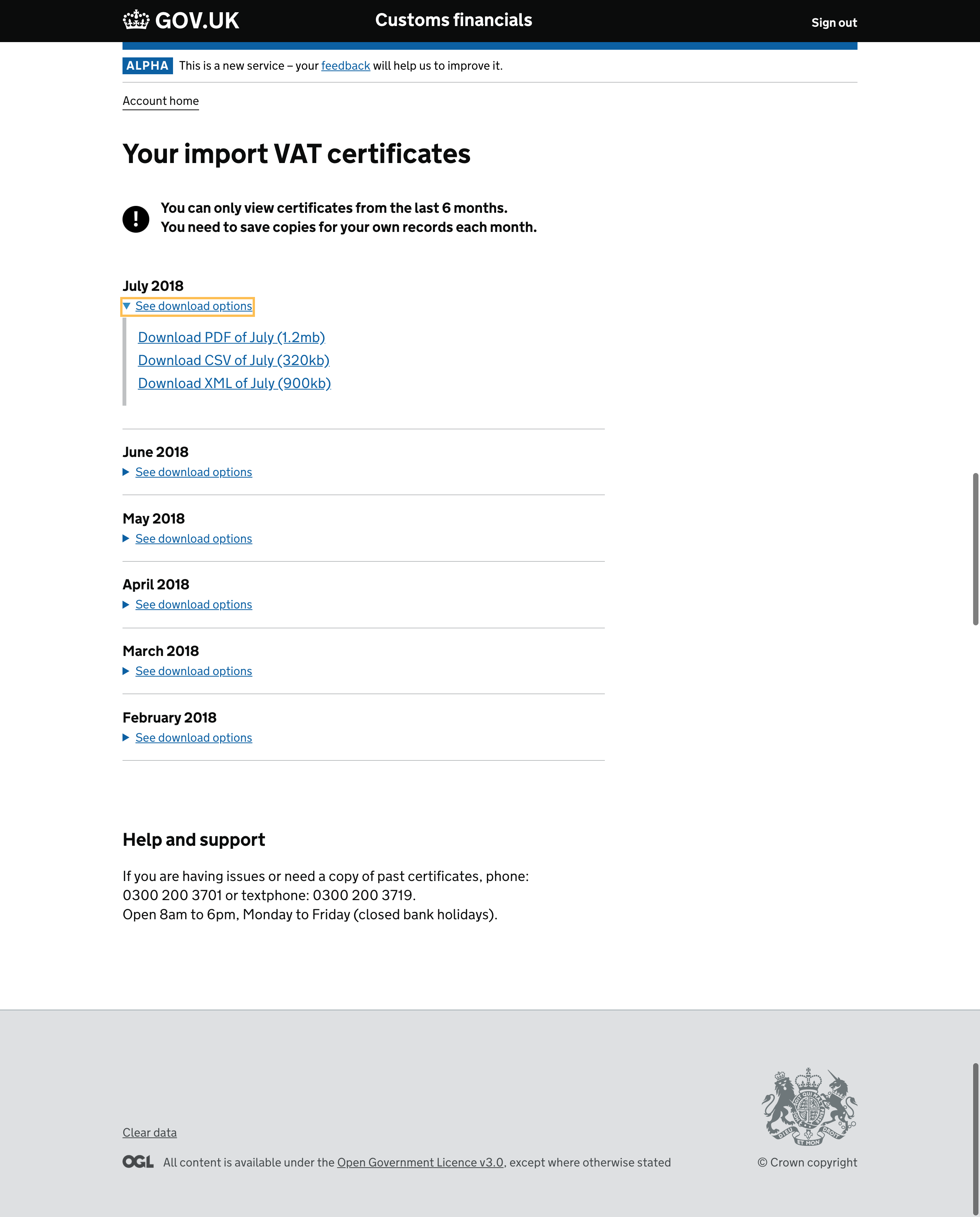

As part of my time at HMRC, I was working to change a current paper process into a new, online service which meets GDS and internal HMRC standards. This is part of a strategic piece of work to replace a backend system. The service was to allow users to receive evidence of any duty paid to HMRC which they need for their VAT returns.

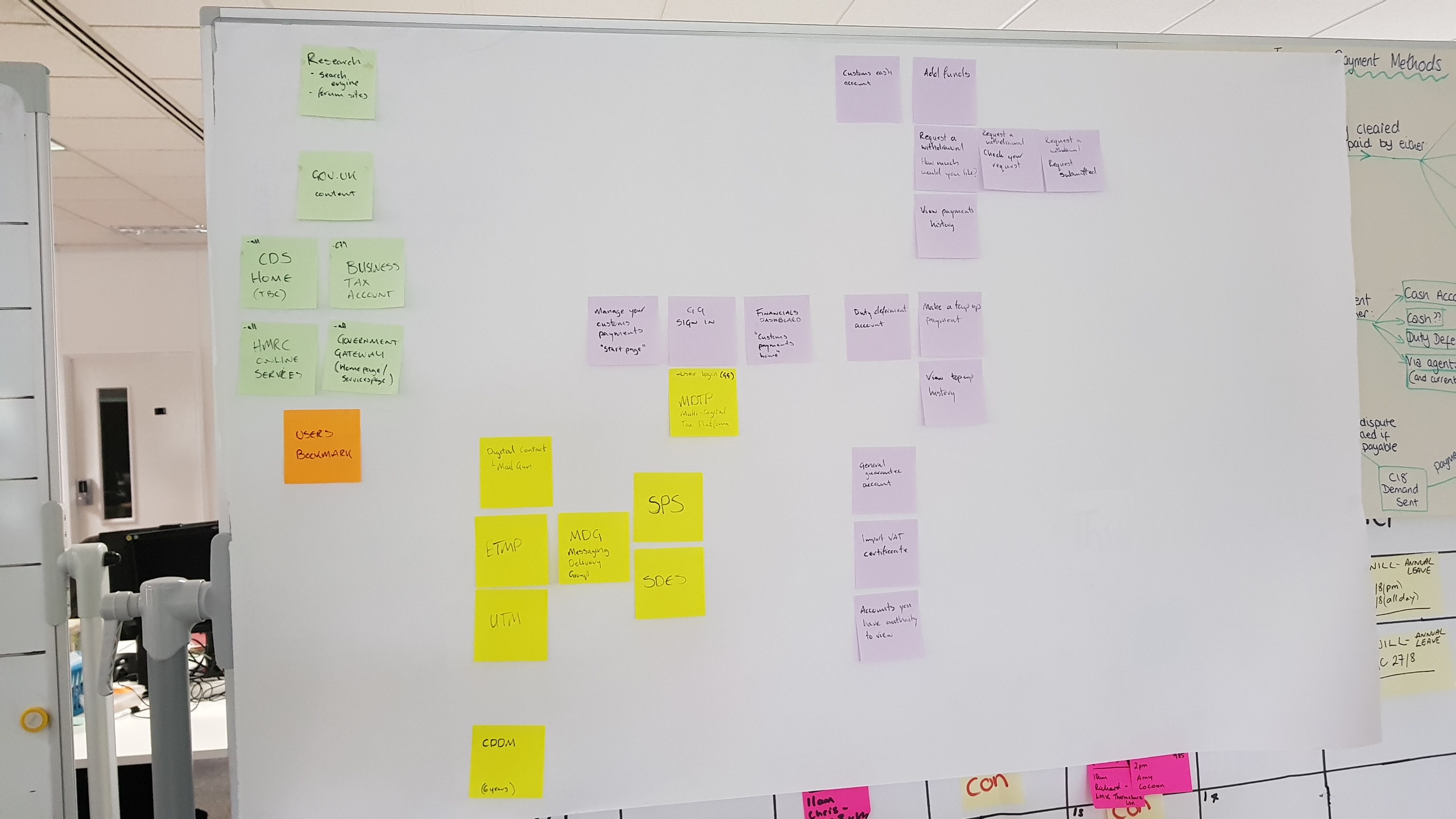

As the Interaction Designer on an agile team, I was responsible for understanding the current process, the organisational requirements for the new service and the needs of the users for the new service.

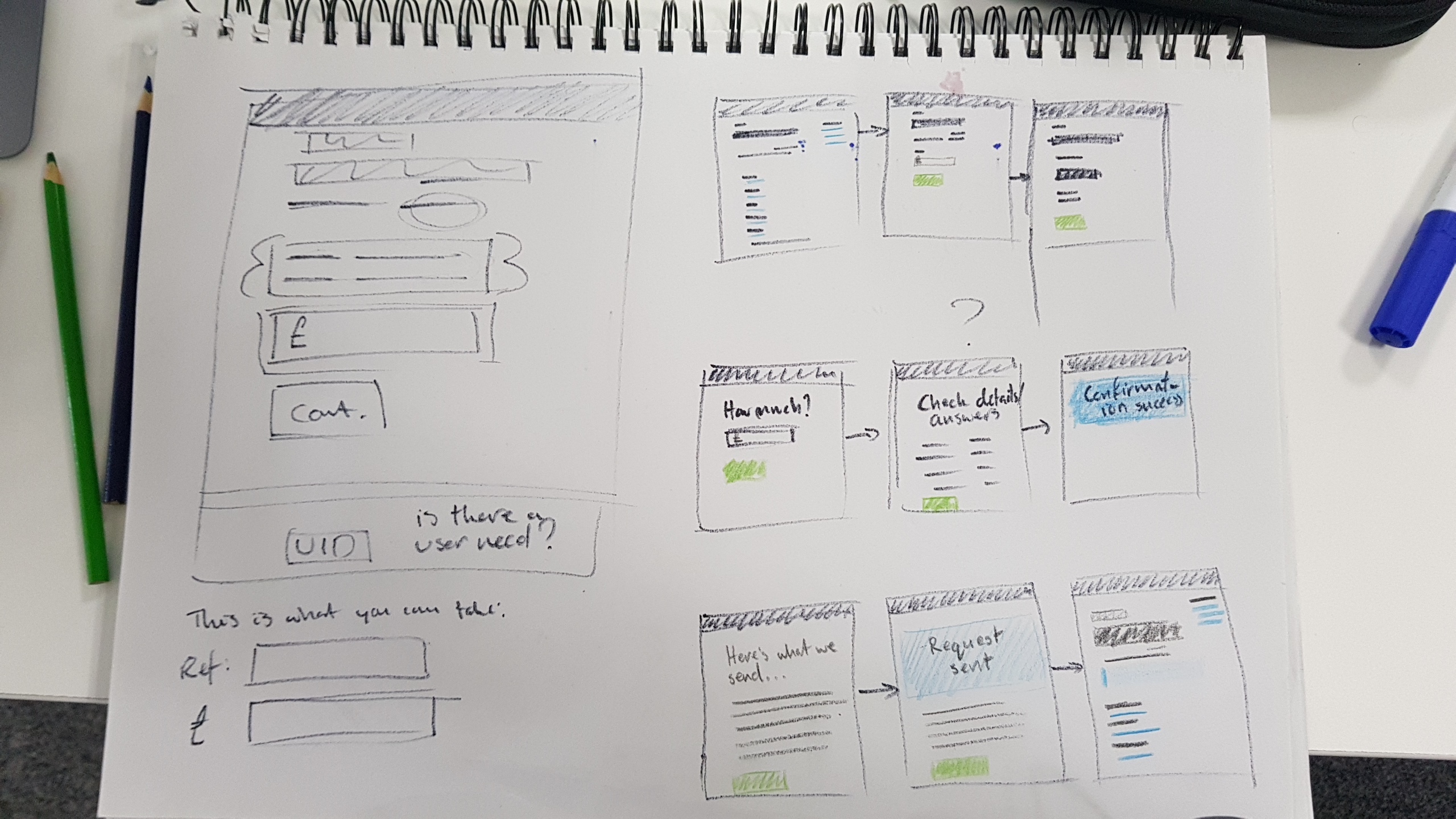

I worked closely with the user researcher to help facilitate research sessions with users of the current process and with the Business Analysts to understand the organisational requirements. I used the knowledge I gained from both of these and other team members to design the initial journeys through the service, which were then tested with users and iterated.

The service has been assessed at multiple stages and met GDS standards. It has now gone into private beta and is successfully sending users their C79 evidence for their VAT returns. The user feedback has been positive so far and the service is meeting user needs while meeting organisation requirements.