Self assessment peak 2020

HMRC has a legislative requirement for people to be able to file their tax returns by a specific date. There are a lot of people who leave this until close to the deadline, resulting in an increase in contact to HMRC call centers, a lot of which are lost or forgotten credentials.

As part of a pre-discovery team, I was tasked with understanding the problems users were facing which resulted in contact from users. I also worked to understand what solutions had been explored previously to help users self-serve if they had lost or forgotten their credentials.

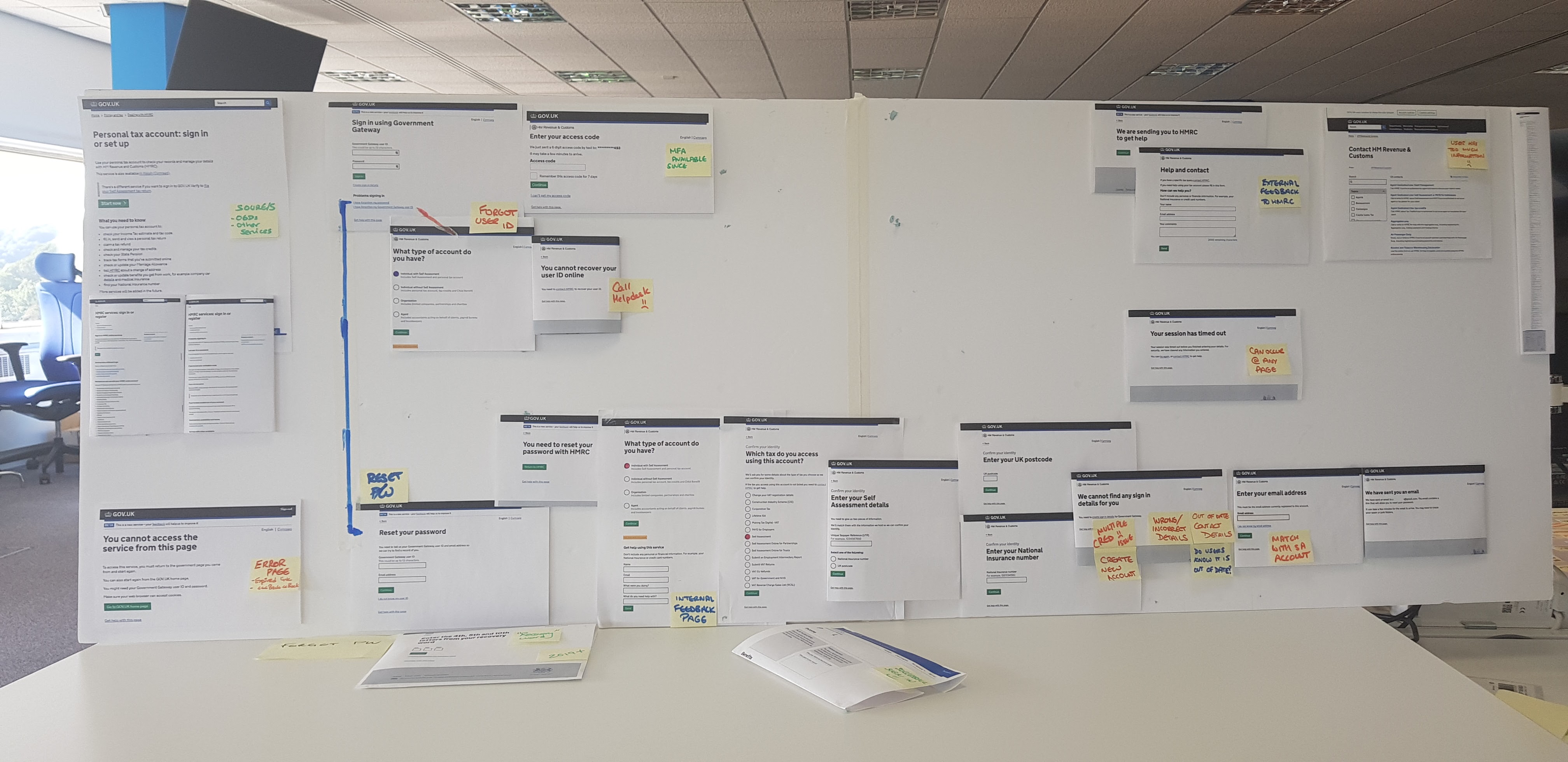

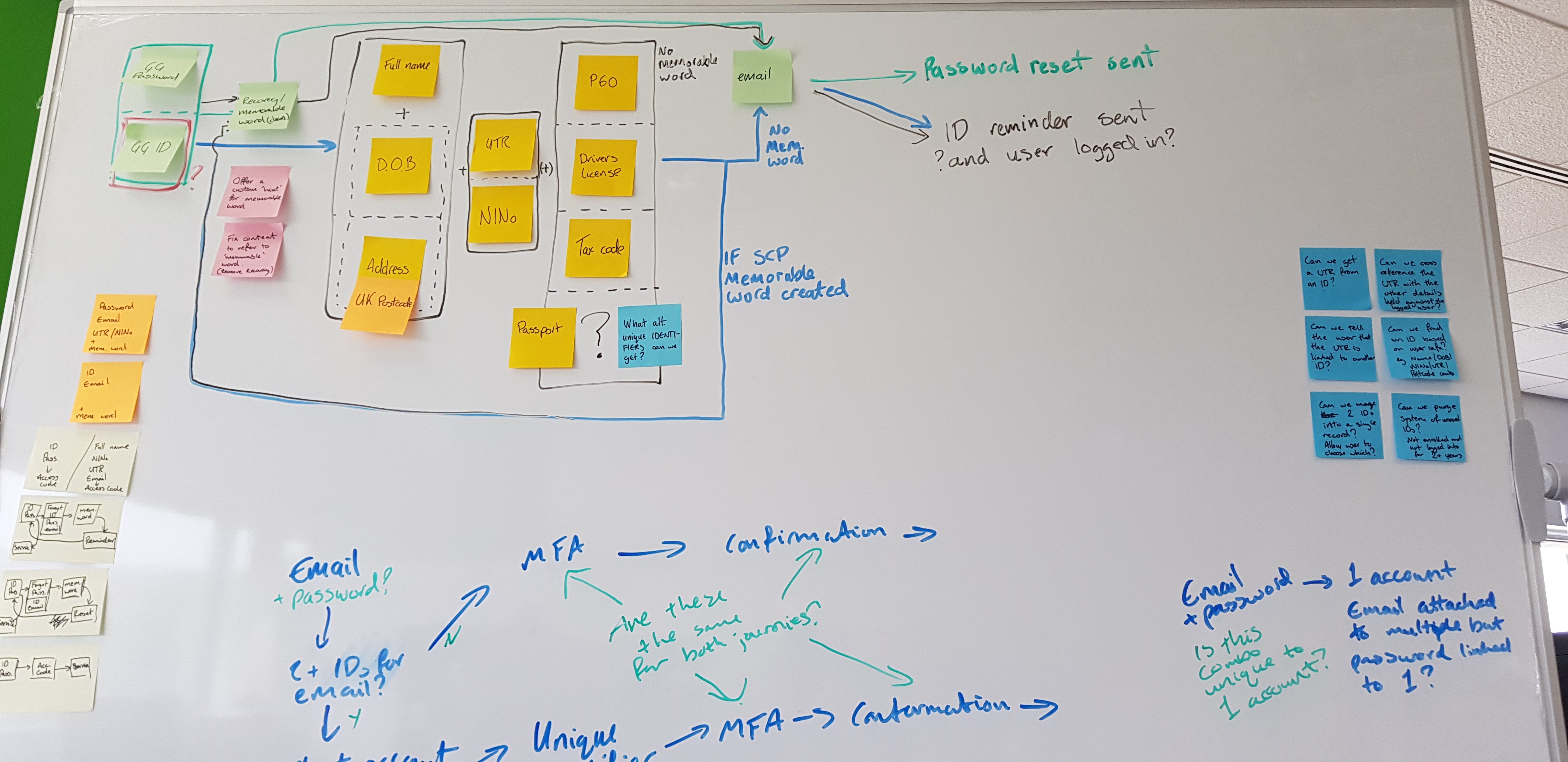

My role within the team was to understand the current journey and what evidence there was of the problems the users were facing through reviewing notes and workshops with the existing service design teams. Some speculative design work had been done by previous and existing teams, I reviewed these designs with a multidisciplinary team, then made recommendations based on viability and cost.

This allowed HMRC to prioritise the various delivery teams workload meaning the most viable solutions have been delivered in time for the peak. The support teams are feeling more confident that this will reduce contact.